All you need to know about lic surrender value and paid up value of your lic policy

Most of the time, lic policy holders are confused about the option of whether to surrender the lic policy or to make it paid-up. To understand this, you need to know what is paid-up value and what surrender value is. Your policy becomes a paid-up policy when you stop paying premiums for your lic policy after paying premiums for a few years.

Let us understand this with an example. Suppose you purchased a policy with a sum assured of 10 lakh. Where you have to pay a premium for 20 years. Now, after 5 years, you stopped paying a premium for your policy. It will become a paid-up policy. Remember you will not be getting any amount from LIC after five years. To get your money back, you must wait until the policy period's end. As you are still holding the policy and have stopped paying premiums, your sum assured value will be reduced. We can use the formula for the new sum assured to calculate this value. Which is nothing but Paid up value.

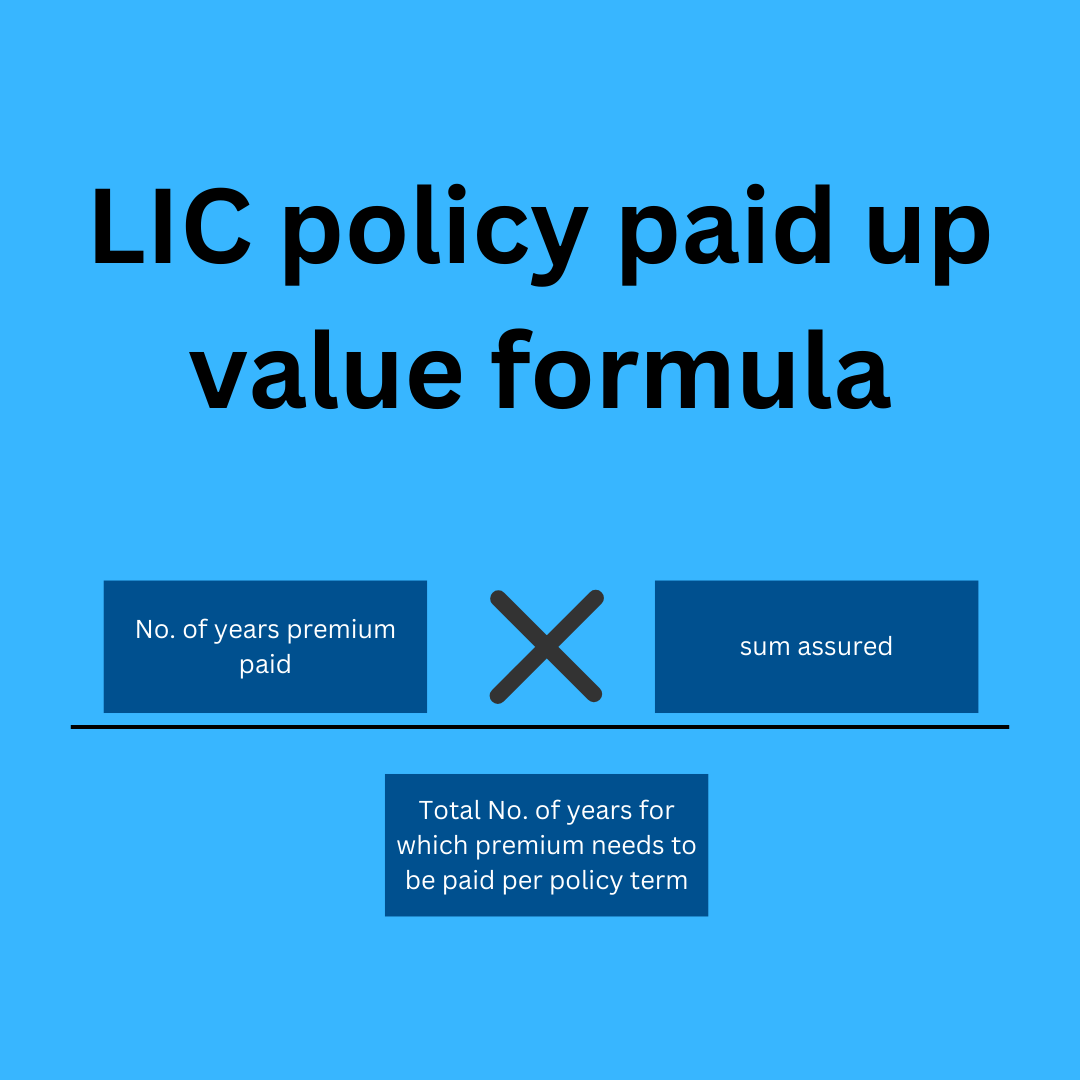

(No. of years premium paid) X (sum assured)/(Total No. of years for which premium need to be paid)

since we have stopped paying premium here after 5 years so for this eaxample

No. of years premium paid = 5

Sum Assured = 1000000

Total number of years for policy term = 20

Now paid up value as per formula will be 5x1000000/20 = 250000

As per this formula your new sum assured for your policy will be 2.5 lakhs. So in simple words paid up value is nothing but your reduced sum assured when you stop paying premiums. you will get this amount only in case of policy holders death or you have to wait until completion of policy term i.e. 20 years in above example. To convert your policy into paid-up policy you will have to pay premiums at least 3 years. For most of the Lic plans like lic Jeevan saral , Jeevan aanad, Lic child plans etc.

Now we will try to understand surrender value of lic policy. Surrender value of lic policy is value you will get back in the form of money, if you wanted to stop paying premiums and you dont want any insurance cover further. In this case your surrender value after 5 years in above example will be calculated by using our calculator licsurrendervaluecalculator.in

It will be always better to convert your policy into paid-up policy as compared to surrendering it, Because in most of the cases, if you have paid premium for less years your surrender value will be negligible as compared to paid-up value. You can refer to surrender value chart for lic policy by visiting licsurrendervaluecalculator.in

I hope you understood difference between lic policy surrender value and paid up value