Life insurance vs General Insurance: What's the Difference?

If someone asks me a question: What is the difference between life insurance and General insurance? I will say, life insurance gives coverage for human life, and General insurance gives coverage for nonliving things. However, there are many things we need to know about life insurance and general insurance. We will try to understand key diffrences between both.

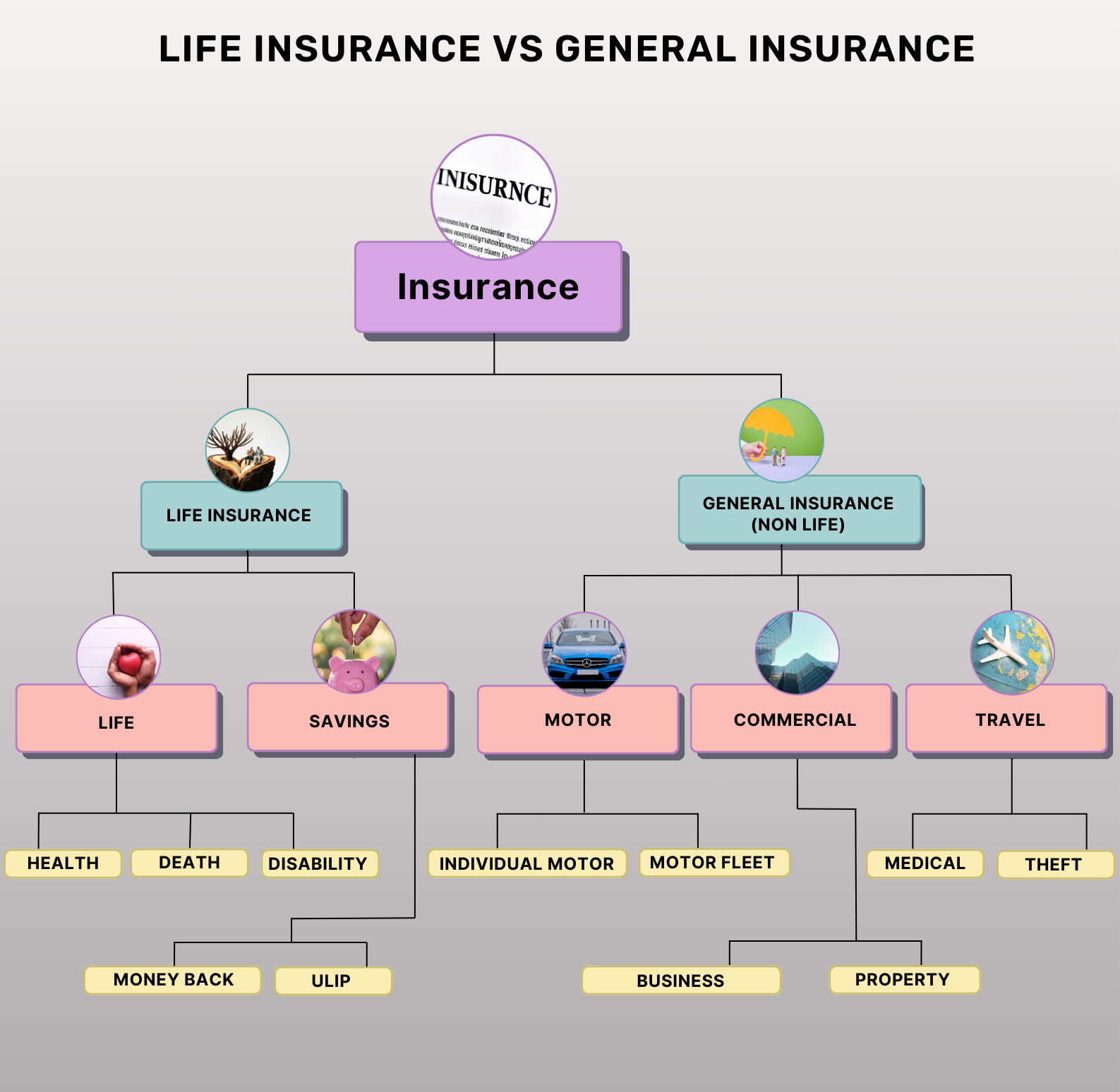

First, we will talk about life insurance. Life insurance is generally subdivided into two parts: life and savings. In life insurance, the insurer (a company that provides insurance) gives cover for insured persons' death (term insurance), permanent disability and insurance coverage for critical illnesses. It means an insured person pays a premium for protection against any mishappening with his life. If anything wrong happens, the person or his heirs will get the amount from the insurance company equal to the sum insured for that particular cover. Also, there is another part of life insurance, which is called savings. In savings, people usually keep paying premiums for the defined period per policy terms. Then, At the end of the insurance contract period, the insured person will get a certain amount with interest, which he has already paid in the form of insurance premiums. Generally, insurance companies sell plans which include the benefits of life insurance as well as savings. In this kind of plan insured person will get coverage for life, permanent disability, and any critical illness during the policy period. Along with these coverages, policy holder (insured person) will also get his money back with some bonus amount (interest). However, an Insured person should choose an insurance plan that gives him life coverage only as it will reduce its premium amount significantly. For savings or investment purposes, he can use other investment instruments like mutual funds. ULIP (unit-linked insurance plan) and money back plans usually generate lower returns as compared to mutual funds. You can check the image below to see what type of insurance comes under which category.

Now we will talk about General insurance. General insurance has three major catagories motor insurance, commercial insurance and Travel insurance. all other insurance for non living things also comes under general insurance but we will not cover that all catagories here. above mentioned are major catagories of general insurance.you can see image above for understanding. In Motor insurance there are two catagories individual motor where insurer provides insurance for single vehicle like your Car and Bike. where as Fleet insurance is for Group of vehicles. For example, if you are running transport business and you have number of trucks for transportation. In that case you can take Fleet insurance. Motor insurance gives you protection against acceidents, it covers bodily injuries also covers third party vehicle damage and insured vehicles damage due to acceident etc. Another important section in general insurance is commercial insurance where insurance company provides insurance for buildings, factory and buisnesses. insurer provide here protection against natural calamities like earthquake, Flood, buisness interuption due to any of the mentioned reasons in the policy terms. so in short commerical insurance provides protection for your business and property per policy terms.Now Lets talk about Travel insurance part of general insurance. In travel insurance insurance company provides Traveller protection against theft of laggage, expenses occured due to cancellation of Trip also provides protection against medical illness when you travel abroad. it is useful to have travel insurance when you travel abroad. As in many countries medical treatment is so expensive that it can distrupt your whole budget of trip. And ofcourse it is good to have insurance cover for theft when you travel new places.